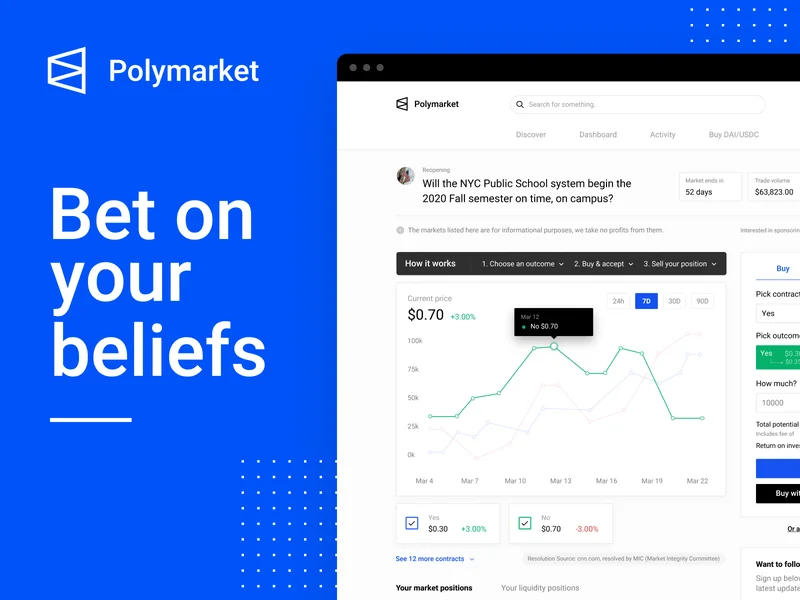

Okay, friends, buckle up, because we're about to dive headfirst into a fascinating corner of the future—one where the collective intelligence of the crowd is not just predicting events, but actively shaping them. I'm talking about prediction markets like Polymarket and Kalshi, and what their surging popularity really means.

Forget those dusty old polls that are always wrong anyway. These platforms aren't just asking people what they think will happen; they're putting real money on the line. And that, my friends, changes everything. It's skin in the game, amplified by the wisdom (and sometimes the folly) of thousands of participants.

Take the upcoming New Jersey governor election, for example. According to recent reports, Polymarket traders are heavily favoring Democrat Mikie Sherrill, with a staggering $5.1 million already traded on the outcome. Kalshi traders, while also leaning towards Sherrill, are a little more cautious about the margin of victory. Who is ahead in NJ governor race? Latest Kalshi, Polymarket odds in Ciattarelli, Sherrill What I find so compelling is that this isn't just about political gambling; it's about real-time information aggregation. It's about people from all walks of life, using their knowledge, their networks, and their gut feelings to assess the situation and place their bets accordingly.

This surge in activity isn't just a fluke. As one report notes, Polymarket saw a record high of nearly half a million monthly active traders in October. Polymarket activity rebounds to new highs while Kalshi dominates in volume We're talking about a genuine groundswell of interest, driven, in part, by the anticipation of Polymarket launching its own cryptocurrency and airdrop. But it's also driven by something far more profound: a growing recognition that these platforms offer a more accurate, more dynamic, and, dare I say, more democratic way of understanding the world around us.

Think about it. In the past, we relied on experts, on pundits, on talking heads to tell us what to expect. But these prediction markets are tapping into something far more powerful: the distributed intelligence of the masses. It's like Wikipedia for the future, constantly updating and refining its predictions based on the latest information and the collective wisdom of its users. And with Polymarket's planned relaunch in the US, this trend is only going to accelerate.

But here's where it gets truly interesting. These markets aren't just predicting the future; they're influencing it. Imagine a company trying to decide whether to launch a new product. If the prediction markets are heavily betting against its success, that might give the company pause. It might prompt them to rethink their strategy, to address potential weaknesses, to ultimately increase their chances of success. In other words, these markets are creating a feedback loop, where predictions become self-fulfilling prophecies.

Of course, there are risks. The potential for manipulation, for insider trading, for the amplification of biases – these are all legitimate concerns. And we need to be mindful of the ethical implications of turning everything into a betting market. But the potential benefits – greater transparency, more accurate information, more informed decision-making – are simply too great to ignore. It's a bit like the early days of the internet: a chaotic, unregulated frontier, full of both promise and peril. But with the right safeguards and the right mindset, it could revolutionize the way we understand and interact with the world.

Kalshi, notably, is already receiving investment proposals valuing the company at up to $12 billion. Think about that for a second. Twelve billion dollars. That's not just a bet on a company; it's a bet on the future of information itself. It's a recognition that the old ways of predicting and understanding the world are no longer sufficient. And it's a sign that we're entering a new era, where the wisdom of the crowd is not just a nice idea, but a powerful force shaping our reality. When I first saw these numbers, I honestly just sat back in my chair, speechless.