It’s official, folks. The powers that be have dropped the numbers for `medicare premiums for 2026`, and if you’re a senior who was hoping for a little breathing room, well, I’ve got some news. It ain’t good. Senior citizens will pay a lot more for Medicare in 2026, and they’ve managed to pull off the classic magic trick: give with one hand, snatch back with the other. And honestly, it’s getting harder and harder to pretend I’m surprised.

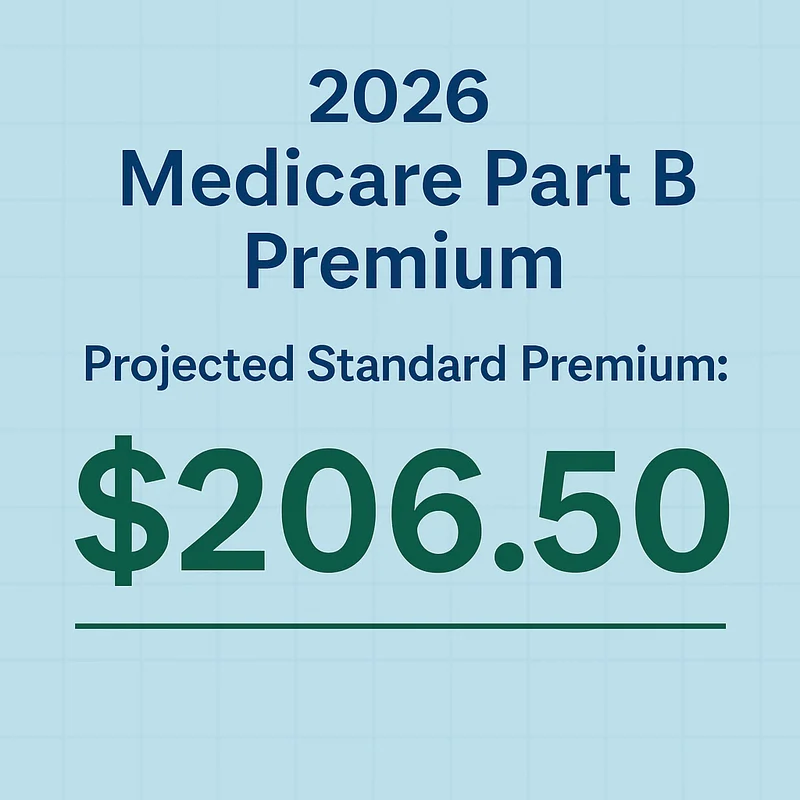

The big headline? Your standard `medicare part b premium` is jumping by nearly 10% – that’s $17.90, pushing it to $202.90 a month. Let that sink in. A nearly ten percent hike. Now, remember that 2.8% `2026 social security increase` they were touting? The one that gives the average retiree a whopping $56 extra a month? Yeah, I’m no math whiz, but $17.90 out of $56 leaves you with... well, significantly less than $56. For millions of dual enrollees, that `medicare part b premium 2026` increase is gonna swallow a huge chunk, if not all, of their Social Security COLA. Medicare Just Announced Its 2026 Premiums, and It's Bad News for Social Security's Dual Enrollees. It's like getting a tiny raise at work, only to find your landlord immediately raising the rent by almost the same amount. What’s the point, I ask you? What's the damn point?

This isn’t just some minor adjustment; this is the largest Part B increase in four years, and the second-largest dollar hike in the program’s entire history. Let’s be real, this `medicare cost 2026` is a gut punch, especially when you consider healthcare affordability is already a nightmare. Jeanne Lambrew, some director at The Century Foundation, called it "distressing." Distressing? That’s putting it mildly. It’s infuriating. It’s a cynical move by people who clearly aren’t living on fixed incomes.

And then you get the typical corporate platitudes. Dr. Mehmet Oz – yeah, that Dr. Oz – from CMS, had the gall to say, "Millions of Medicare beneficiaries will continue to have access to a broad range of affordable coverage options in 2026." Affordable? Sir, with all due respect, what planet are you on? When `medicare part b premiums will increase for 2026 cutting into social security increases`, that ain't affordability, that’s a squeeze. It’s like telling someone they have "affordable options" while they're drowning, and you're offering them a choice between two different colors of lead weights. Give me a break...

Oh, and let's not forget the pat on the back CMS gave itself for "preventing an additional $11 Part B premium increase" by slashing payments for skin substitutes. Call me crazy, but celebrating that you only ripped people off for $17.90 instead of $28.90 isn’t exactly a win. It’s like a mugger saying, "Hey, I could've taken your shoes too, but I didn't. You're welcome." The fact that they spent over $10 billion on those products last year, up from $256 million in 2019, suggests maybe the problem isn't just seniors, but the insane, unchecked spending that eventually lands on their doorstep. But offcourse, that's too complex for a soundbite.

If you thought traditional Medicare was the only place getting hit, think again. The `medicare advantage` market is getting hammered too. For the second year running, the number of MA plans is shrinking – down 10% to 3,373 plans for 2026. Major insurers like CVS Aetna, Elevance, Humana, and UnitedHealthcare are pulling back, affecting over 2 million people. And get this: for the first time ever, some folks in 8 Vermont counties will have zero Medicare Advantage plans to choose from. Zero.

This isn’t just a slight inconvenience; it’s a complete erosion of choice. Brooks Conway, some principal from Oliver Wyman, tried to spin it: "If seniors in the standalone PDP market are willing to shop, there is still stability." Shop? What are they supposed to shop for? Air? When options are disappearing, and you’re telling seniors to "shop," it feels less like advice and more like a cruel joke. I can almost hear the collective groan from millions of seniors who just want reliable healthcare, not a scavenger hunt.

Not only are there fewer plans, but the ones remaining are getting worse. Fewer MA plans will offer $0 deductibles for prescription drugs, and maximum out-of-pocket limits are rising nearly 10%. Even those "supplemental benefits" everyone loves to talk about, like dental allowances, are getting skimpier. The average dental allowance is down 10% to $2,107. So, you’re paying more, getting less, and your choices are disappearing faster than my patience with corporate double-speak. It’s a classic bait-and-switch. They lure you in with promises of comprehensive care, then slowly, incrementally, chip away at the benefits while jacking up the costs. It’s infuriating to watch. Then again, maybe I'm just too cynical for this brave new world where "affordable" means "we're taking more of your money."

Let’s not sugarcoat it. These `medicare premiums 2026` announcements are a kick in the teeth for American seniors. It’s a slow, painful squeeze from every direction. The government and the insurers are playing a cynical game of musical chairs with people’s health and retirement funds, and it's the most vulnerable who always end up without a seat. If you ask me, this whole thing stinks.